Accept More Business Payments

How Can We Help?

Banking Built for Business

Explore our suite of Business Banking products and services designed to help your business thrive.

Business Checking

Business Savings

Digital Banking

Credit & Financing

Cash Management

Merchant Services

We Help to Create Business Success Stories

Whether you are an entrepreneur leading a fresh start-up or a fourth-generation business owner sustaining your family’s legacy, a partnership with Fidelity Bank can help you grow. Our team of knowledgeable bankers is ready to get to know you, your goals and dreams, and recommend the most valuable Business Banking solutions to get you there. We’ll be right by your side every step of the way.

They’ve been there every step of the way to help me grow my business, every time.

– Hank McCullough

Financial Wellness at Work

Optimize your benefits package and deliver greater value to your employees – with our free At Work program. Empower your employees with a suite of resources designed to simplify their banking and support their long-term goals. Resources include checking and savings accounts, digital banking, financial wellness check-ups, discounts on select lending solutions,1 buyer’s protection and extended warranty,2,3 prescriptions, vision, and hearing discounts, and much more!

Manage Your Business on the Go

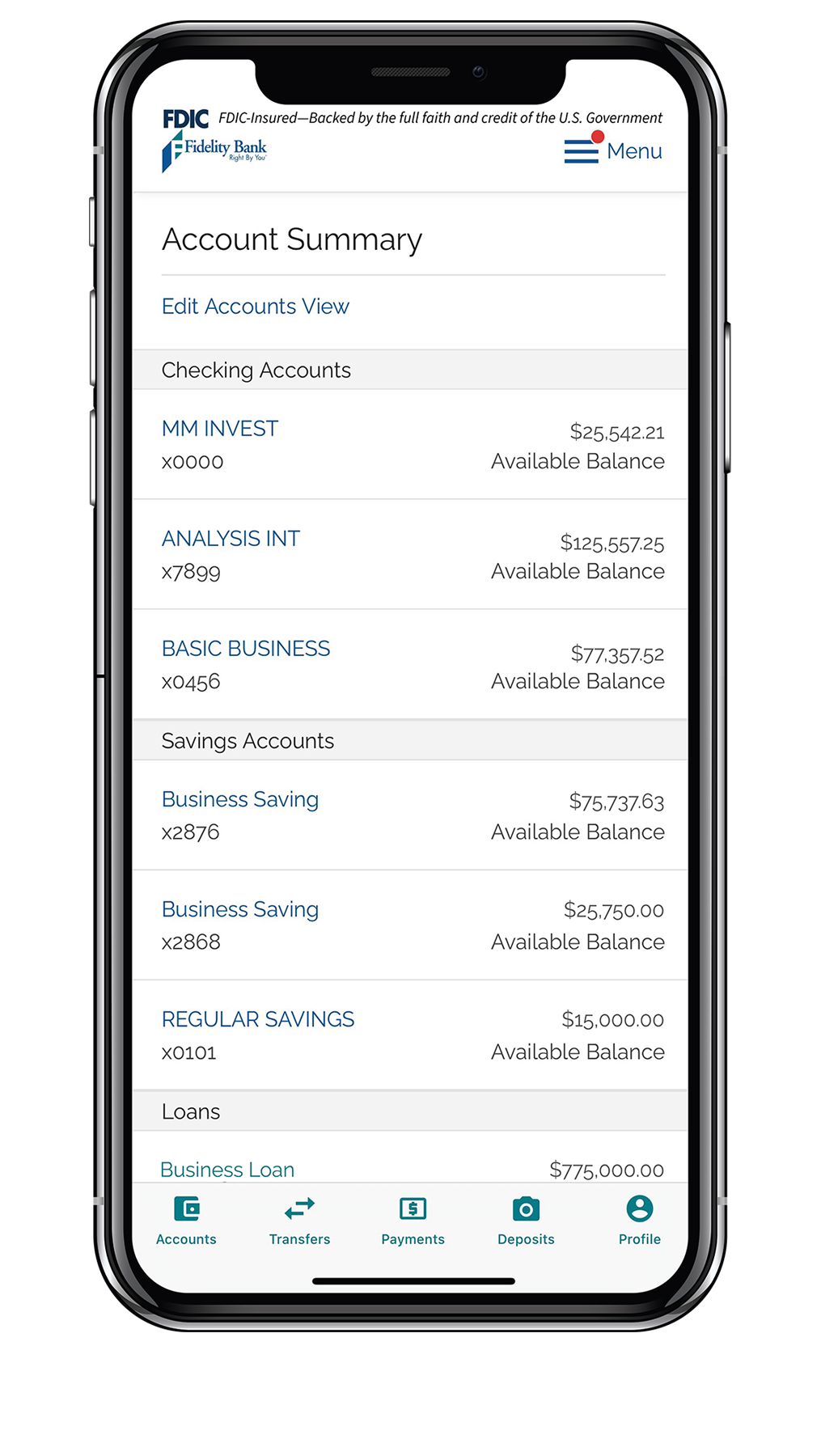

Manage Your Account From Anywhere

Securely access your Fidelity Bank business account 24 hours a day. Check your balance, pay bills, deposit a check, set alerts, and more!

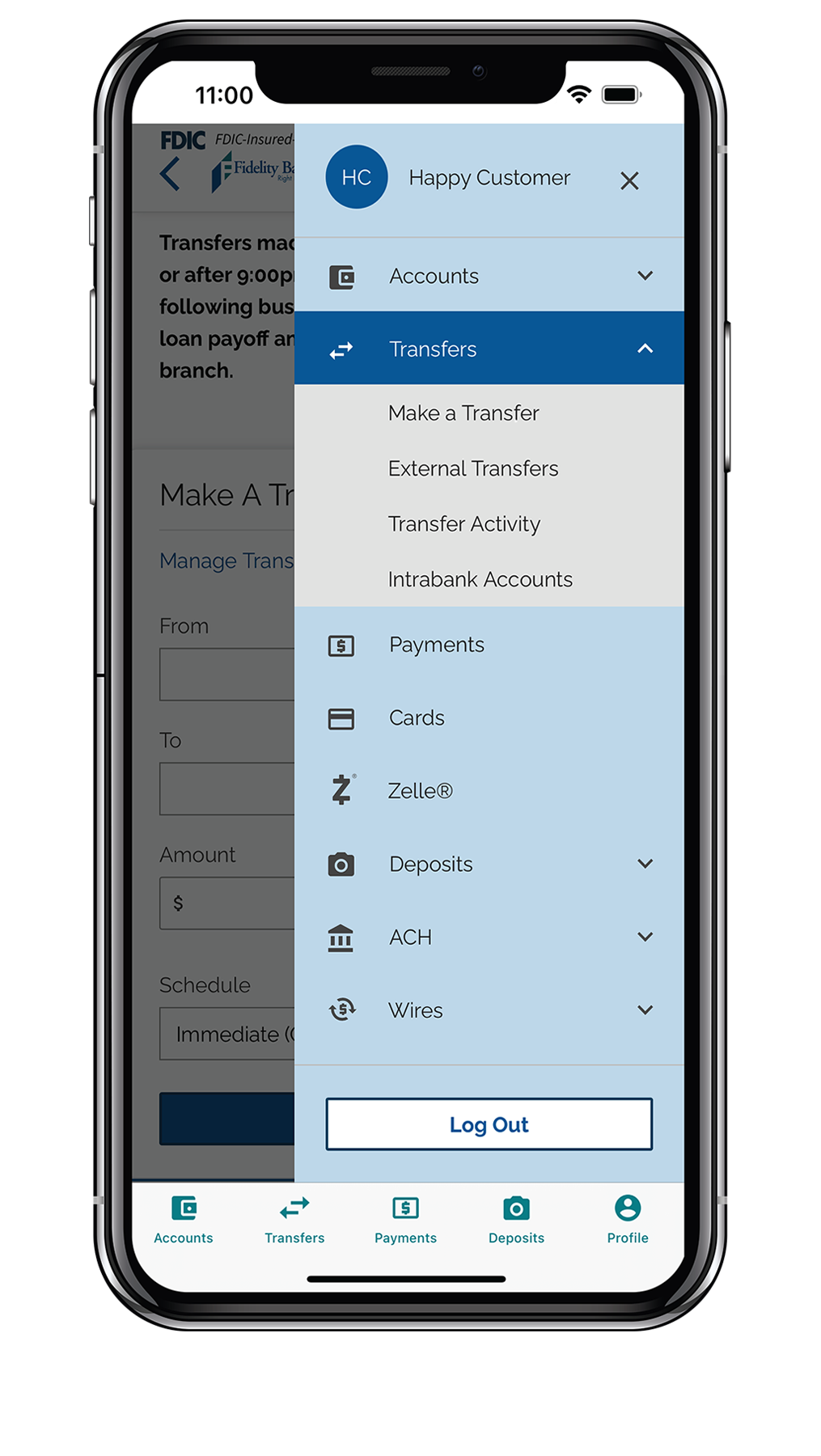

Send Money

With our mobile app, you can initiate ACH and wire transfers safely and conveniently from your mobile device to save you time.

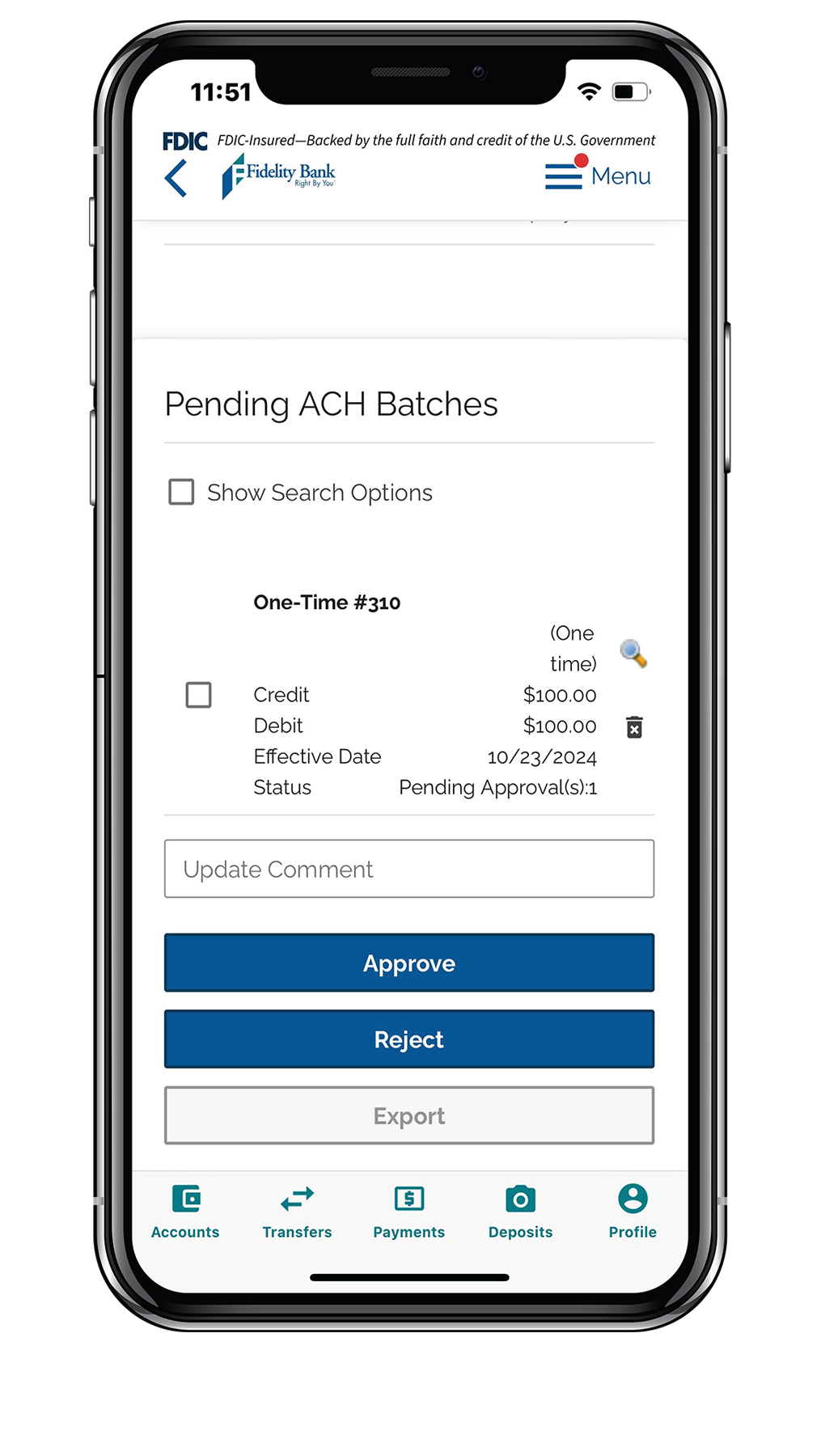

Approve Transactions

Protect your business against fraud and simplify the approval process. Approve funds transfers, ACH transactions, wire transactions, and more – all from your mobile device.

Frequently Asked Questions

- Subject to credit approval.

- Subject to terms and conditions detailed in the Guide to Benefits.

- Insurance products are: NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE BANK.