Business Resources

Need further information about banking with us? Get the knowledge you need for financial success with business banking resources from Fidelity Bank.

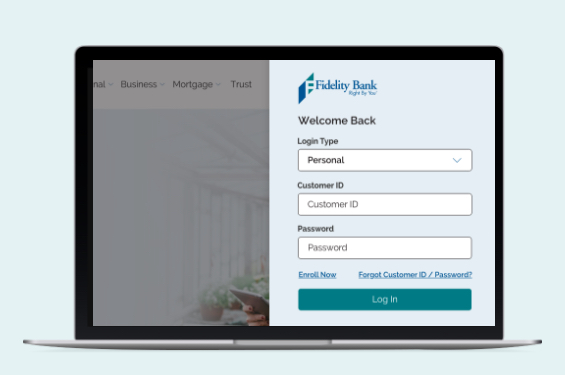

Demos

Want to learn more about Fidelity Bank’s mobile, online, or other digital solutions? Choose an option below to see an informative video tutorial on how it works.

Business Customer

User Guides

Read our informative guides to learn how to perform select business banking tasks.

Account Opening Requirements

Opening an account with Fidelity Bank is quick and easy. We just need some common information from you to get started.

Additional Resources

Looking for something else? Learn about privacy and security, reorder checks, and more below.

Int’l Incoming Wire Instructions – Contact your banker

Need Further Help?

If none of our resources provide what you need, our team is here to help you get answers. Call your business banker or visit your local branch, and we’ll be happy to assist you.