Special Offer for Business Owners:

Receive Big Benefits With an At Work Account and No Monthly Service Charge.

How Can We Help You?

Committed to Being

Right By You®

100+

Years

Fidelity Bank is a Bank built on values. Since 1909, our mission has guided us to do what’s right for our customers, our community, and our associates.

5

Rated

Fidelity Bank earns the loyalty of our customers. With over 1,600 five-star Google reviews, our superior attention to caring and personal service helps us build relationships that span lifetimes – even generations.

High Touch

Service

Fidelity Bank is committed to helping our customers succeed. We’ll be right beside you with the right solution to meet your needs whether you are banking from home, the road, or at one of our branches.

Bank on the Go With Fidelity Bank Mobile Banking

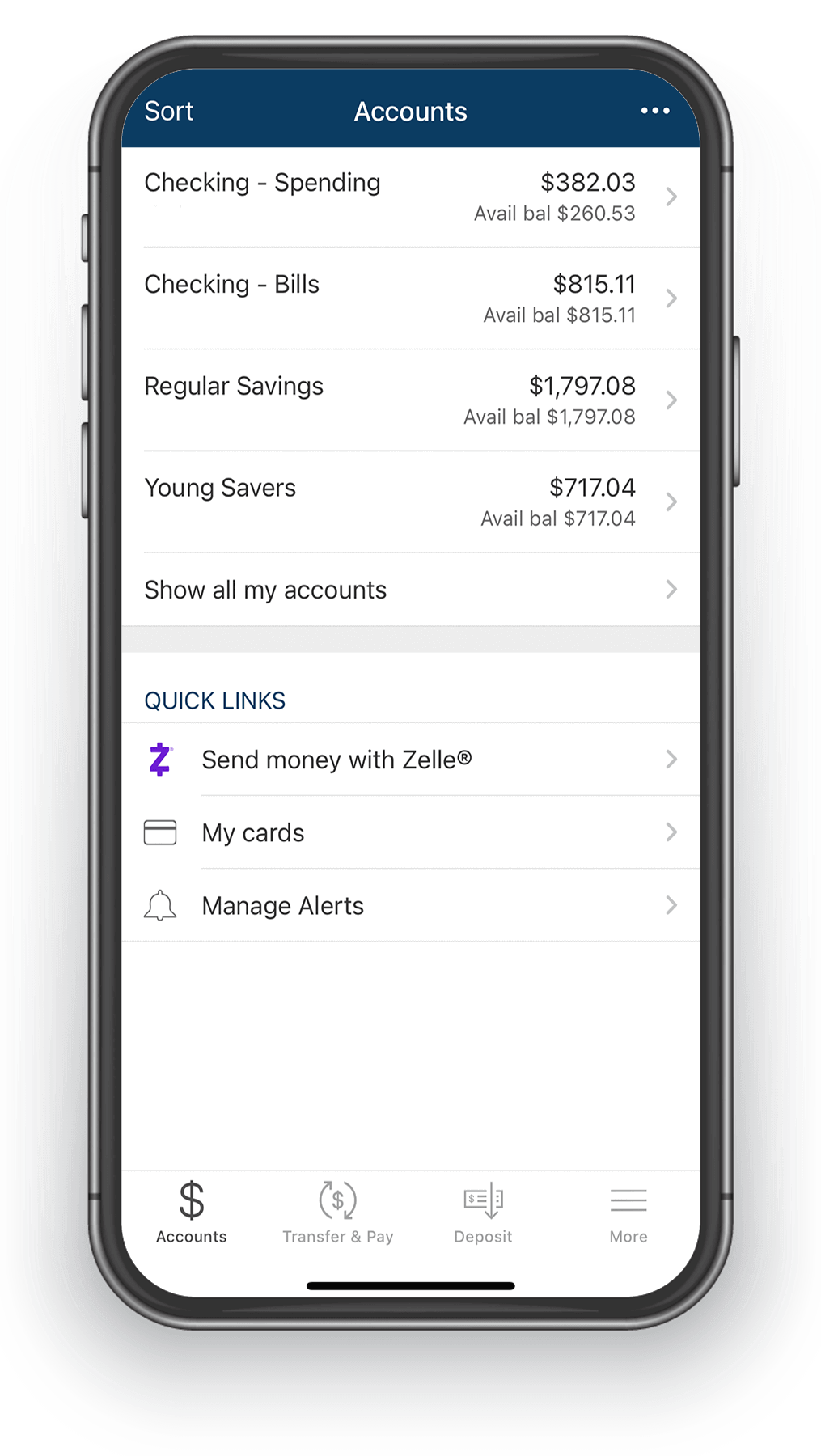

Manage Your Account From Anywhere

Securely access your Fidelity Bank account 24 hours a day. Check your balance, track your spending, pay bills, deposit a check, and more!

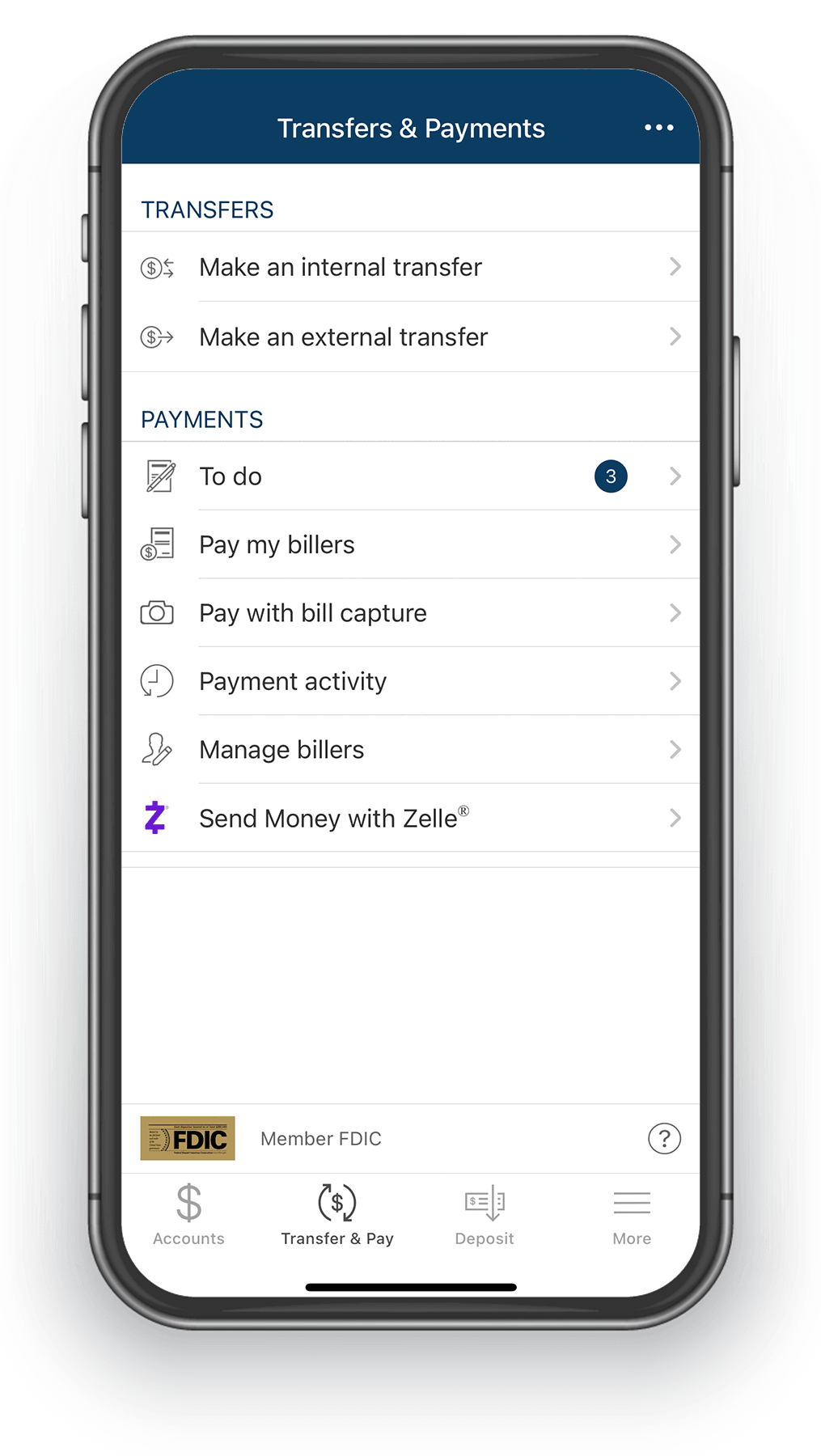

Easily Move Money

Transfer funds, send money to another financial institution, and pay family and friends with Zelle®– and all conveniently from your mobile device.

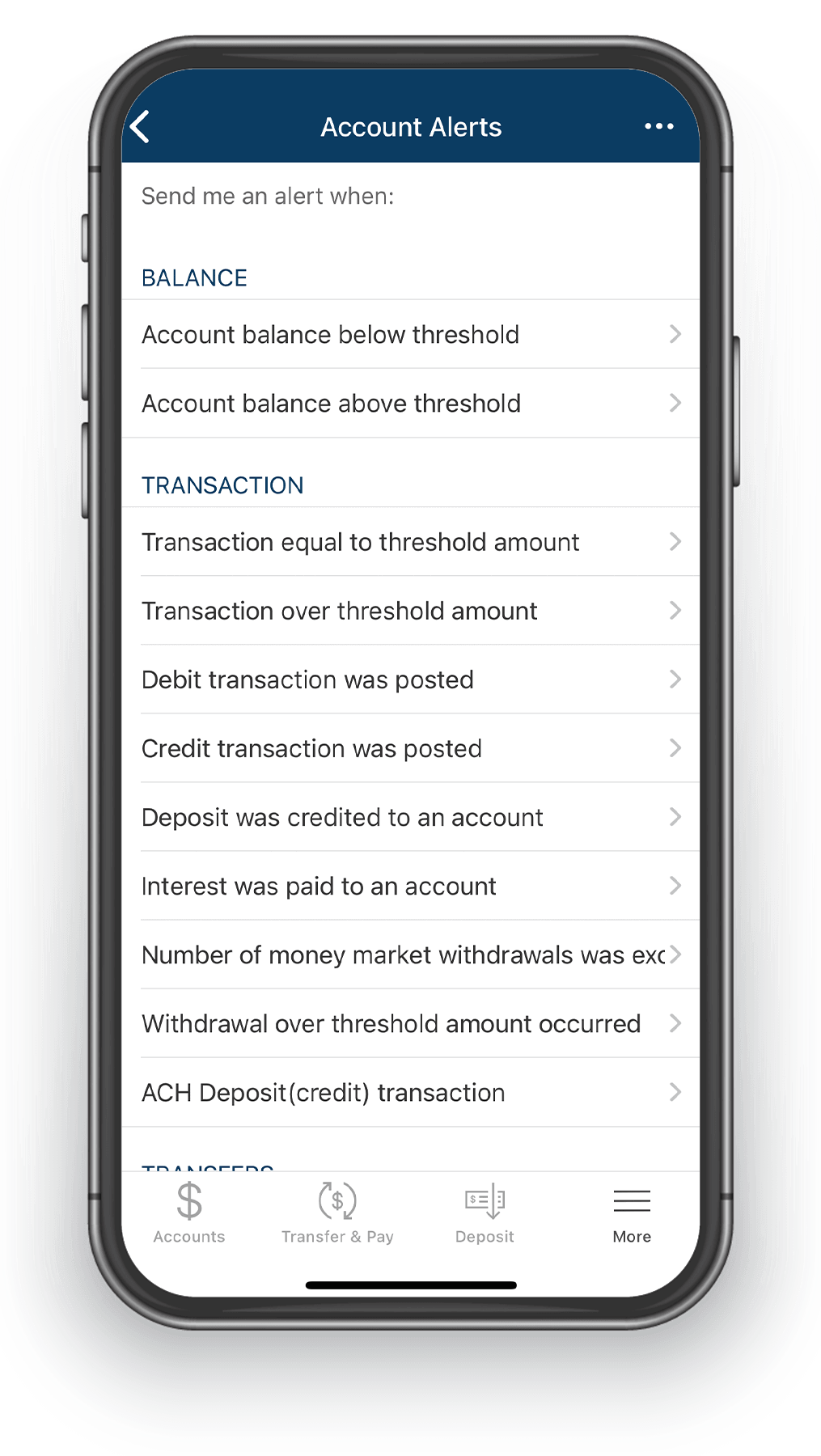

Protect Your Account With Alerts

Gain peace of mind with Alerts from Fidelity Bank. You can set account and transaction level alerts so you’re always in the know.

Right By You®

Right By You is more than our tagline. It’s been our commitment to be there when you need us, to offer sound financial advice, and to do the little things that help make your life easier. For over 100 years, Fidelity Bank has been helping people just like you. Find out why businesses and families come to us first – and bank with us for generations.

Fidelity Bank has been very good to us for many, many years. We’ve enjoyed working with them to help support our local community.

– David McNeill

We Love Our Community

Fidelity Bank and its associates are committed to giving back to the communities we serve. We’re proud to support causes that help people in need and work with local organizations to help make our communities stronger. Our associates also volunteer their time to causes close to their hearts. In all the areas we serve, Fidelity Bank and our associates are dedicated to being vital participants in our community.